A solid winner on $wfc

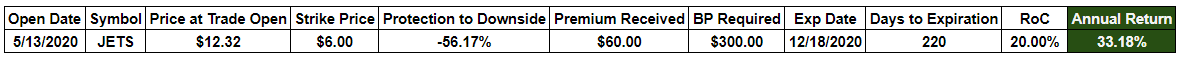

On 5/13/2020 with JETS trading at $12.32 we recommended our subscribers sell a $6 put option expiring on 1/15/2021 for a limit price of $0.60. Here were the trade details at trade opening:

The U.S. Global Jets ETF (JETS) was trading at a significant discount relative to its 52 week high of $32.36. While we liked JETS at the $12 level as a long term investment the $6 price would be even better! Especially when we could get paid 20% for getting the opportunity to do so. Due to the increased volatility in the stock market JETS premiums were trading for more than they usually do. These are exactly the opportunities we look for – high quality stocks trading at already high discounts with increased volatility. At trade opening, members immediately got paid $60 per put option contract they decided to sell.

What would be the worst case scenario in opening this trade?

We would be obligated to purchase 100 shares of JETS at $6 meaning we would be purchasing them for a 56% discount to the $12.32 price.

What actually happened after we opened the trade?

After opening the trade on 5/13/2020, shares of JETS hovered between $12 and $16 until the end of May. In the first week of June shares jumped between the $16 and $22 level.

On 6/4/2020 we successfully closed the position by purchasing the contract we sold at $65 for $15, netting a profit of $45 per contract.

So why did we close it out early?

While we still believed JETS would stay above $6 between now and 1/15/2021 (the expiration date of the option), the goal of our newsletter/advisory service is to maximum annual returns.

While we could have made the $60 letting the option expire worthless on 1/15/2021, we made over half ($45) of the full potential profit of $60 in just 23 days instead of 220 days.

Here are the trade details after closing the trade:

Summary

Sure, we could have just bought JETS on 5/13/2020 at $12.32 and we still would have been profitable. But the beauty of selling puts is the amount of protection we have if the stock price were to fall further. As seen from above we had downside protection of over 56% meaning that we would only start to lose money if the shares fell over 56%! At that point you would have been buying shares of JETS for an adjusted cost of $5.4o! Selling puts on an ETF such as JETS is even better than selling puts on an individual stock due to the diversity of ETFs. Selling puts, as seen from the explanation above and through our closed trades, is a phenomenal income producing strategy.